Select Trust: Secure Trust Foundations for Your Building And Construction Ventures

Select Trust: Secure Trust Foundations for Your Building And Construction Ventures

Blog Article

Securing Your Properties: Trust Fund Foundation Proficiency within your reaches

In today's complex economic landscape, guaranteeing the security and development of your properties is extremely important. Trust foundations function as a keystone for securing your riches and heritage, offering an organized technique to possession protection. Expertise in this world can provide invaluable support on browsing lawful complexities, making best use of tax performances, and developing a durable financial plan customized to your special needs. By touching into this specialized knowledge, individuals can not just safeguard their properties efficiently but likewise lay a solid foundation for long-lasting wealth conservation. As we explore the complexities of depend on structure expertise, a world of possibilities unravels for fortifying your monetary future.

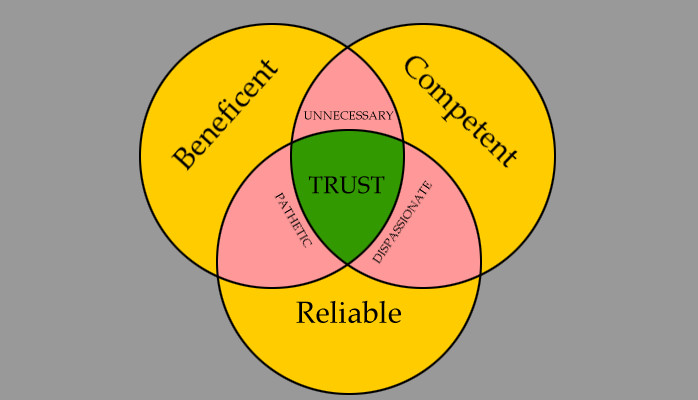

Value of Trust Foundations

Trust fund structures play a vital duty in developing trustworthiness and fostering strong partnerships in numerous professional settings. Structure count on is important for businesses to flourish, as it creates the basis of successful cooperations and partnerships. When depend on exists, people feel more positive in their interactions, bring about boosted performance and effectiveness. Count on foundations act as the foundation for ethical decision-making and transparent interaction within companies. By focusing on trust fund, companies can create a positive work culture where staff members feel valued and valued.

Advantages of Specialist Advice

Structure on the structure of rely on professional connections, seeking specialist guidance provides invaluable advantages for individuals and organizations alike. Expert guidance gives a riches of expertise and experience that can aid browse complex economic, lawful, or critical obstacles with convenience. By leveraging the knowledge of specialists in various areas, people and companies can make educated decisions that straighten with their objectives and goals.

One substantial benefit of expert advice is the ability to access specialized expertise that may not be conveniently available or else. Experts can offer insights and viewpoints that can bring about ingenious options and possibilities for development. Additionally, dealing with specialists can aid reduce dangers and uncertainties by giving a clear roadmap for success.

Furthermore, professional support can save time and resources by streamlining procedures and avoiding costly errors. trust foundations. Specialists can offer individualized guidance tailored to certain requirements, making sure that every decision is educated and critical. Overall, the benefits of specialist assistance are multifaceted, making it a beneficial property in protecting and making best use of possessions for the long term

Ensuring Financial Safety And Security

Guaranteeing monetary protection involves a multifaceted method that incorporates different elements of riches administration. By spreading out investments across various asset classes, such as supplies, bonds, real estate, and commodities, the danger of significant economic loss can be mitigated.

In addition, preserving an emergency fund is necessary to safeguard versus news unexpected expenses or earnings disruptions. Specialists suggest reserving three to 6 months' well worth of living expenses in a fluid, easily available account. This fund acts as an economic security web, providing assurance during rough times.

Regularly assessing and readjusting financial plans in reaction to altering circumstances is likewise extremely important. Life occasions, market variations, and legal adjustments can affect monetary security, emphasizing the value of recurring evaluation and adjustment in the search of long-lasting financial protection - trust foundations. By carrying out these approaches attentively and regularly, people can fortify their economic footing and job in the direction of a more safe and secure future

Securing Your Properties Effectively

With a solid structure in place for financial safety via diversification and reserve upkeep, the next crucial step is safeguarding your possessions effectively. Safeguarding assets includes safeguarding your wide range from possible risks such as market volatility, economic declines, claims, and unforeseen expenditures. One effective method is possession allocation, which entails spreading your financial investments across different asset classes to decrease danger. Expanding your profile can assist alleviate losses in one area by balancing it with gains in an additional.

Furthermore, developing a trust fund can supply a safe way to shield your assets for future generations. Trusts can aid you regulate just how your possessions are distributed, reduce inheritance tax, and safeguard your wealth from lenders. By implementing these strategies and seeking specialist recommendations, you can safeguard your properties properly and protect your economic future.

Long-Term Asset Protection

Lasting asset protection entails carrying out procedures to secure your assets from different risks such as financial downturns, lawsuits, or unanticipated life occasions. One critical facet of lasting possession security is establishing a trust fund, which can use considerable benefits in protecting your possessions see from creditors and lawful disputes.

In addition, expanding your investment portfolio is one more crucial strategy for long-lasting possession defense. By taking a proactive approach to long-lasting possession protection, you can protect your wide range and offer economic safety and security for yourself and future generations.

Final Thought

In verdict, trust structures play a critical role in safeguarding assets and making certain financial safety and security. Specialist guidance in establishing and managing depend on structures is vital for long-lasting asset protection.

Report this page